Pascal Ströing - Munich Center for Mathematical Philosophy

Werbung

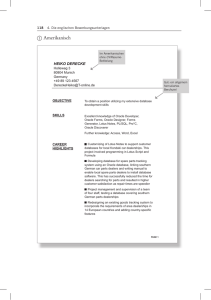

Pascal Ströing Particulars Illungshofstraße 21 D-80807 Munich Germany Education Philosophy Phone: E-Mail: +49 171 7614518 [email protected] PhD student, LMU Munich (MCMP) since October 2013 • Supervised by Stephan Hartmann • Dissertation project: How are Phenomena in Science Related to Patterns in Data? M.A. (M.Phil.), LMU Munich October 2010 • Main subjects of study: philosophy and history of mathematics, philosophy of science, logic, epistemology, metaphysics • Title of master thesis: How Monstrous are Fefermans Monsters? – Kinds of Intuition in Modern Mathematics (orig. German) B.A. (Zwischenprüfung), LMU Munich December 2008 Mathematics M.Sc. (Diplom), LMU Munich and KTH Stockholm, Sweden November 2012 • Title of the diploma thesis: The Multifractal Model of Asset Returns for the Risk Management of Stock Positions (orig. German) • Examination subjects: mathematical finance, theory of probability and stochastic processes, functional analysis, logic B.Sc. (Vordiplom), LMU Munich April 2009 Abitur, Werner-von-Siemens-Gymnasium in Gronau (Westf.), Germany Scholarships and Grants Doctoral scholarship from Studienstiftung des deutschen Volkes, Further Activities Mathematics June 2006 increase of German public study grant by completing in the top third in math Supervisor, TU Munich (KPMG CERM) since May 2013 • Co-supervision of Master’s theses in mathematical finance. Submitted: ◦ Fuchs, M. Markov-Switching Multifractal Models with Applications. ◦ Ickenroth, T.: Dynamic Investment Strategies under Behavioral Aspects. 1 of 3 Teaching and Courses Philosophy [1.] Tutor for Bachelor’s course “Einführung in die Wissenschaftstheorie”, A. Reutlinger, 2016 [2.] Teaching assistant for Master’s course “Central Topics in the Philosophy of Science”, S. Hartmann, 2015 Industry [3.] At KPMG: two day block course “Einführung in Produkte und Märkte für Finanzdienstleistungen”, two times per year [4.] At Deutsche Bank: “Quantitative Modelle des Risikomanagements (für nichtMathematiker)”, 2011 Presentations [1.] “New Insights on the Metaphysics of Phenomena and Patterns in Data”, conference New Trends Metaphysics of Science, Paris, (17/12/2015) [2.] “An Introduction to Mathematical Finance for Philosophers”, Munich (MCMP), (22/11/2012) [3.] “The Multifractal Model of Asset Returns” (Master’s thesis defence), Munich, (09/05/2012) Work Experiences I mention my industrial experiences, because it shaped my interests and approaches to problems – in primarily positive ways :-) KPMG AG in Munich, Germany since March 2013 Consultant: Market Risk Management KPMG/MRM advices financial instituts on matters of risk management • Develop quantitative solutions for changing risk management requirements • Advise clients on regulatory requirements for the financial sector • Manage IT implementations of risk management solutions Deutsche Bank AG in Frankfurt a. M., Germany October 2011 to January 2012 Intern: Private Wealth Management/Financial Engineering Group DB/PWM/FEG engineers quantitative hedging strategies for multi-asset portfolios on the buy side • Develop allocation and hedge strategies for long term investments based on historical price data and stochastic models Sky Media Network in Unterföhring, Germany February 2011 to May 2011 Developer SMN sells air time for advertising at SKY TV in German speaking countries • Develop quantitative models for viewer forecasts of major sports broadcasts (esp. football) based on viewer statistics and stochastic modelling 2 of 3 Earlier Work Experiences Opwoco in Coesfeld, Germany April 2005 to October 2006 Web-Developer • Build web applications in HTML, PHP, MySQL Technical Experiences MATLAB, TEX Programming and databases: C, C++, Bash, Java, JavaScript, PHP, Python, SQL, VB, VBA, XML (HTML) OS: UNIX (Linux Debian) Languages German (mother tongue) English (fluent written and spoken) Swedish (basic knowledge) 3 of 3