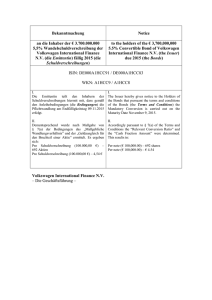

Österreichische Volksbanken-Aktiengesellschaft € 10,000,000,000

Werbung