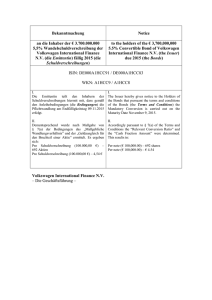

BASE PROSPECTUS DATED 10 December 2008 LEVADE S.A. A

Werbung